Transforming Banking Through AI Financial Services

AI Financial Services are changing banking by making processes faster, safer, and more convenient for customers in the digital age.

AI Financial Services are changing the way banks work by making everyday tasks faster and smarter. From helping customers with their questions to spotting unusual activity, AI is becoming a helpful tool in many areas. It supports better decision-making, reduces errors, and allows banks to serve people more effectively. With AI, banking becomes simpler, secure, and reliable, helping both businesses and customers benefit from smoother and more efficient services.

Upgrading Customer Experience with Intelligent Interfaces

The banking industry is shifting from traditional, in-person interactions to smarter, AI-driven experiences. With the rise of artificial intelligence for banking, intelligent interfaces such as virtual assistants and chatbots now deliver personalized, 24/7 support. These tools are transforming how financial institutions serve customers, enhancing convenience, speed, and overall customer satisfaction.

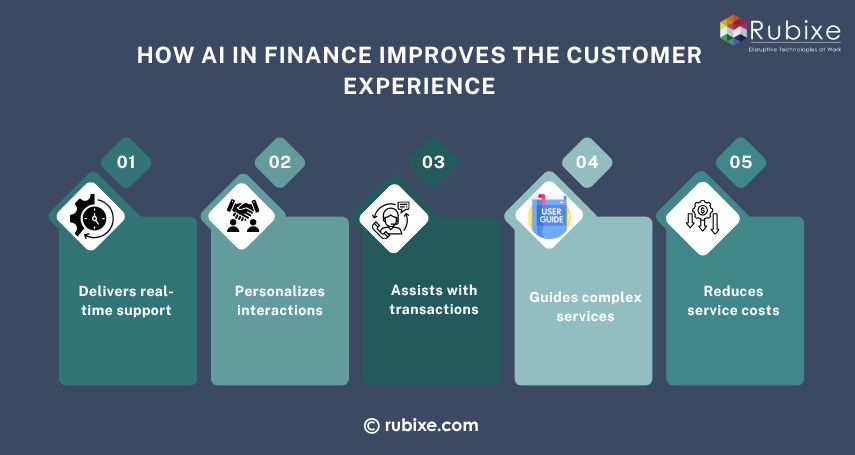

How AI in banking improves the customer experience:

-

Delivers real-time support: Chatbots provide instant answers to routine questions, reducing wait times across various AI financial services.

-

Personalizes interactions: AI tools understand customer behavior and preferences to tailor responses, making AI in banking feel more human.

-

Assists with transactions: Virtual assistants help users check balances, transfer funds, and manage accounts easily through seamless AI services.

-

Guides complex services: AI supports loan applications, investment planning, and other high-value decisions, improving trust in AI consulting for banking.

-

Reduces service costs: Automation efficiently handles large volumes of customer queries without the need for increased staff.

-

Increases customer retention: By enhancing support with AI-powered financial services, banks foster stronger relationships, loyalty, and long-term customer satisfaction.

Smarter Fraud Detection and Security

As digital transactions grow, so does the need for intelligent, real-time protection. AI in banking and AI financial services plays a crucial role in preventing fraud, securing data, and maintaining customer trust. These technologies help banks detect threats early and respond faster than ever before.

How artificial intelligence for banking enhances fraud detection:

-

Monitors transactions in real time: AI systems in AI financial services scan for unusual patterns to stop fraud before it occurs.

-

Analyzes user behavior: Machine learning tools assess typical customer activity and flag deviations that may signal compromised accounts.

-

Automates alerts and actions: AI instantly sends notifications and can pause suspicious transactions for added protection.

-

Improves regulatory compliance: With support from AI consulting, financial institutions align security systems with evolving regulations.

-

Reduces false positives: Smarter detection means fewer unnecessary holds on legitimate transactions.

-

Boosts customer satisfaction: Enhanced protection builds confidence and long-term relationships with clients.

More Accurate Risk Management and Loan Approvals

Lending decisions require a fine balance between opportunity and risk. With the support of AI financial services, banks now make faster, more accurate decisions by analyzing vast sets of financial and behavioral data. Artificial intelligence for banking reduces bias, increases transparency, and improves access to credit for a broader customer base.

How AI in banking improves risk evaluation and loan processing:

-

Assesses creditworthiness precisely: AI analyzes income, transaction history, and alternative data to create a fuller risk profile.

-

Speeds up loan approvals: Automated systems review applications, verify documents, and make real-time decisions without delays.

-

Reduces manual errors: AI reduces inconsistencies by applying uniform standards across all applications.

-

Detects early warning signs: AI models monitor loan performance and predict potential defaults before they escalate.

-

Improves regulatory alignment: AI helps banks meet compliance standards with clear, data-backed decisions.

-

Expands financial inclusion: Smarter risk analysis allows institutions to offer loans to previously underserved populations.

Operational Efficiency via Automation

Banks handle a high volume of repetitive tasks every day, from Know Your Customer (KYC) checks to regulatory reporting. With the integration of AI in the banking sector, these activities are being streamlined through intelligent automation. This shift allows teams to focus on more strategic functions while reducing costs and errors.

How AI financial services improve operational efficiency:

-

Automates customer onboarding: Verifies identities, collects documentation, and sets up accounts with minimal manual input.

-

Streamlines reconciliation: AI tools match transactions across systems to identify discrepancies and ensure accuracy.

-

Simplifies compliance reporting: Gathers data from multiple sources and formats it for audit or regulatory submission.

-

Reduces human workload: Staff can shift attention from routine tasks to decision-making and customer engagement.

-

Increases process speed: AI accelerates internal workflows, reducing turnaround times for approvals and updates.

-

Enhances scalability: Banks can grow operations without proportional increases in staffing or infrastructure.

Intelligence-Driven Investment and Portfolio Management

Wealth management is undergoing a major transformation with the rise of AI banking tools. From robo-advisors to algorithmic trading platforms, financial institutions are using AI financial services to offer personalized, real-time investment guidance.

How AI in banking enhances investment and portfolio decisions:

-

Offers real-time market analysis: AI tools continuously scan financial markets to detect patterns and opportunities.

-

Provides personalized investment advice: Robo-advisors align investment options with a client’s goals, risk appetite, and timeline.

-

Automates portfolio rebalancing: AI systems monitor asset allocations and make timely adjustments based on market shifts.

-

Anticipates trends with machine learning: Predictive models analyze historical data to identify potential market movements.

-

Reduces emotional decision-making: Automated strategies help investors stay on course without reacting impulsively to market changes.

-

Increases access to financial planning: AI in banking makes professional-grade advice available to a wider range of clients.

Continuous Compliance and Fraud Prevention

In today's highly regulated financial environment, banks must maintain constant vigilance. With the help of AI in banking, institutions are now better equipped to stay compliant and detect fraud in real time. These AI financial services reduce risk and improve operational integrity without overwhelming compliance teams.

How AI supports ongoing compliance and fraud detection:

-

Monitors transactions in real time: AI systems scan thousands of transactions per second to flag suspicious activity.

-

Detects anomalies with precision: Machine learning algorithms identify patterns that suggest fraud or breaches in regulatory rules.

-

Automates reporting tasks: AI consulting solutions streamline compliance documentation and reduce manual errors.

-

Supports KYC and AML efforts: Identity verification, background checks, and watchlist screenings are faster and more accurate with AI tools.

-

Adapts to evolving regulations: AI financial services can be updated easily to stay aligned with new regulatory standards.

-

Reduces human workload: Automated compliance solutions allow staff to focus on analysis rather than routine data checks.

Advanced Credit Scoring and Financial Inclusion

Traditional credit systems often exclude individuals without formal financial histories. AI-driven credit scoring helps extend financial services to underbanked and underserved populations by analyzing alternative data.

Key approaches to enabling broader access:

-

Use of Alternative Data Sources: Evaluate creditworthiness through utility bills, mobile payments, transaction histories, and behavioral data rather than just credit bureau scores.

-

Behavior-Based Risk Assessment: Analyze patterns such as spending consistency, repayment behavior, or digital footprint to build accurate borrower profiles.

-

Dynamic Credit Scoring Models: Continuously update credit scores as new data becomes available, improving risk evaluation in real time.

-

Customized Credit Products: Create tailored loan products based on deeper insights into customer needs and repayment capacity.

-

Expanding Reach to Unbanked Individuals: Provide access to credit for those without formal financial records, especially in rural or low-income areas.

-

Regulatory-Ready Systems: Ensure AI models are explainable, auditable, and compliant with financial fairness and data privacy standards.

Strategic Benefits of AI Integration

Integrating AI into core banking operations is more than just a tech upgrade. It enables long-term transformation that aligns with evolving customer expectations, regulatory demands, and business goals. From cost savings to improved agility, the benefits of AI in banking are far-reaching.

Key strategic benefits of adopting AI financial services:

-

Enhances decision-making speed: AI-driven insights allow faster responses to market shifts and customer needs.

-

Boosts innovation potential: Banks can launch new products and services quicker by leveraging AI in banking platforms.

-

Improves customer satisfaction: Smarter, faster services lead to better user experiences and increased loyalty.

-

Supports scalable growth: AI automation allows banks to handle more customers and data without scaling up costs.

-

Strengthens competitive advantage: Early AI adopters can outpace competitors through efficiency and personalization.

-

Enables proactive risk management: Predictive analytics from AI consulting tools help banks act before problems arise.

-

Aligns tech with business goals: AI strategies are tailored to the institution's vision, ensuring meaningful impact.

The impact of AI Financial Services is clear and profound, from improving individual experiences to reshaping entire business models. Whether it’s AI in banking, enhanced fraud prevention, or smarter predictive tools, these technologies are transforming how trust, speed, and service are delivered in finance. As an experienced AI consulting company, we help financial institutions adopt and implement these solutions effectively, ensuring they gain real value while staying secure, compliant, and competitive.