How AI Is Transforming the Financial Services Industry

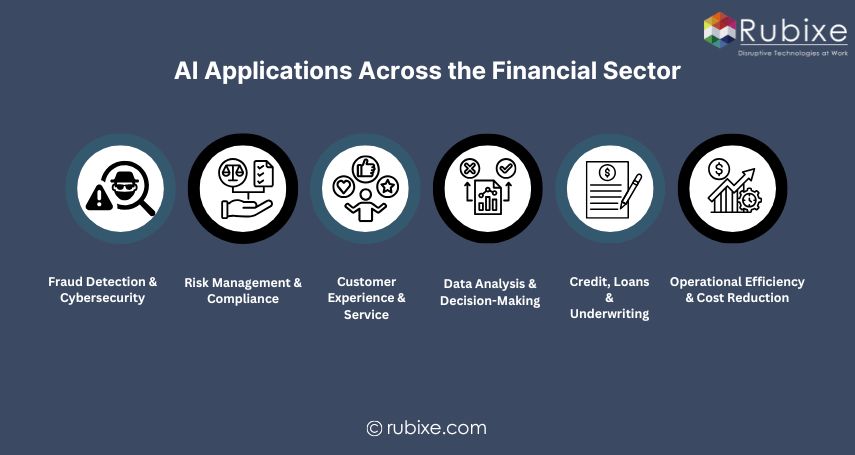

AI is transforming financial services by enhancing fraud detection, automating workflows, improving customer support, and enabling data-driven financial decisions.

I’ve seen how artificial intelligence is making a big difference in the financial world. It’s helping companies work faster, offer more personalized services, and reduce risks. Whether it’s a bank, an insurance company, or a fintech app, AI is changing how things are done.

It’s exciting to watch how smart tools and real-time data are improving the way financial services work. They’re making things easier for both businesses and customers. Here’s how I’ve come to understand AI’s role in finance and the ways it’s helping different parts of the industry grow and improve.

AI’s Growing Role in Finance

AI is playing a bigger role in finance every year. It helps banks, insurance companies, and fintech apps work smarter and faster. From detecting fraud to giving investment advice, AI makes financial services more secure, personal, and efficient.

Many companies now use AI to understand customer needs, manage risks, and make better decisions with real-time data. As technology keeps evolving, AI is not just helpful. It is becoming essential for staying competitive in the financial world.

Fraud Detection & Cybersecurity

Artificial intelligence has become a critical defense mechanism in financial cybersecurity. With growing digital transactions and online banking services, fraud detection systems need to be faster, smarter, and more adaptive.

-

Real-Time Monitoring: AI systems scan thousands of transactions per second to detect anomalies and suspicious patterns instantly.

-

Behavior-Based Authentication: AI products use biometrics and behavioral tracking to verify users and block unauthorized access.

-

Adaptive Threat Detection: Machine learning models evolve with emerging threats, boosting cybersecurity resilience.

Risk Management & Compliance

Managing risk and staying compliant with evolving regulations is complex. AI provides financial institutions with automated, data-driven approaches to minimize exposure and ensure compliance.

-

Dynamic Risk Scoring: AI evaluates credit, operational, and market risk continuously using real-time internal and external data.

-

Automated Underwriting: AI services assess loan and insurance applications instantly, using alternative data and predictive models.

-

Regulatory Surveillance: AI monitors transactions and communications to detect compliance violations proactively.

-

Automated Reporting: Reporting tools generate accurate regulatory documents with minimal human intervention, reducing errors and delays.

Investment & Financial Forecasting

AI is transforming investment strategies and financial planning through automation and predictive analytics. It enables smarter, faster decisions in the fast-paced world of finance.

-

Algorithmic Trading: AI systems execute trades in milliseconds, analyzing real-time market signals to capitalize on micro-opportunities.

-

Robo-Advisors: AI-driven platforms personalize investment strategies based on user goals, market trends, and risk profiles.

-

Financial Forecasting: Predictive analytics use macroeconomic indicators and historical patterns to project earnings, expenses, and market movement.

-

Sentiment Analysis: NLP models scan financial news and social media to gauge public sentiment and influence investment timing.

Customer Experience & Service

AI is redefining how financial institutions engage with customers. From chatbots to personalization, AI enables seamless and intelligent customer experiences.

-

AI Chatbots: Virtual assistants handle customer queries, perform transactions, and offer support 24/7, reducing service costs and improving satisfaction.

-

Personalized Banking: AI analyzes transaction behavior to offer tailored financial advice, product recommendations, and alerts.

-

Natural Language Interaction: AI products enable voice-activated commands and smart interfaces for intuitive banking experiences.

-

Credit Decisioning: AI evaluates non-traditional credit data (e.g., utilities, rent, mobile usage) to offer loans to underserved populations.

Data Analysis & Decision-Making

Financial institutions depend on data for strategic decisions. AI enhances this process by offering real-time insights, scenario planning, and better accuracy.

-

Real-Time Data Processing: AI in financial services enables analysis of structured and unstructured data for timely insights.

-

Scenario Planning: AI models simulate multiple market and business conditions to support long-term strategic decisions.

-

Smart Alerts & Recommendations: AI services generate intelligent prompts based on spending behavior and financial goals.

-

Improved Accuracy: AI minimizes human error in forecasting and decision-making, enhancing confidence across departments.

Operational Efficiency & Cost Reduction

AI plays a crucial role in streamlining back-end operations and reducing overhead. Automation and intelligent systems are optimizing day-to-day workflows across the sector.

-

Process Automation: Tasks like KYC verification, invoice processing, and claims management are handled entirely by AI systems.

-

Reduced Human Overhead: AI services eliminate repetitive work, freeing up teams for high-value strategic functions.

-

Scalable Solutions: Cloud-based AI products scale with business needs, supporting rapid growth without proportional costs.

-

Low-Code Integration: Modern AI tools integrate easily with existing infrastructure, accelerating digital transformation.

Credit, Loans & Underwriting

AI is modernizing credit evaluation and underwriting, making these processes faster, fairer, and more data-driven. This benefits both institutions and customers.

-

Instant Loan Approvals: AI services assess loan applications and approve or reject them in real time based on risk scores.

-

Bias Reduction: AI models trained on diverse data sets reduce human bias in lending and underwriting decisions.

-

Default Prediction: Predictive analytics flag potential defaulters early, enabling proactive mitigation strategies.

-

Custom Lending Products: AI enables hyper-targeted loan offerings based on income, spending behavior, and financial history.

The Role of AI Products & Services

-

AI Products in Action: Tools like biometric scanners, fraud alert systems, and document verification platforms streamline operations.

-

Cloud-Based AI Services: Scalable platforms offer plug-and-play APIs for fraud detection, analytics, chatbots, and forecasting.

-

AI in Industry Applications: Finance is just one vertical; these tools extend to insurance, real estate, and capital markets, showing the broader power of AI in industry.

AI is transforming finance by making services smarter, faster, and more secure. From fraud detection to personalized banking, it’s helping companies grow and serve customers better.

At Rubixe, we build AI solutions that help financial businesses automate tasks, reduce risk, and stay ahead. Ready to bring AI into your financial services? Let’s connect.