Conversational AI Is Changing Banking and Financial Services

Learn how Conversational AI is changing banking and financial services by enhancing customer support, transactions, loans, fraud alerts, and personalized services.

Long waiting times, slow customer support, and confusing banking processes frustrate customers. People waste time on repeated calls or waiting in queues. Banks also face difficulty handling thousands of queries every day without errors.

Conversational AI provides a smart solution to these problems. It allows customers to get instant answers via chat or voice, anytime. Banks can automate routine tasks, reduce human errors, and improve response speed. It also helps staff focus on more important work while the AI handles repetitive queries.

Using Conversational AI services, banks can deliver faster, smarter, and more customer-friendly experiences. This technology not only improves satisfaction but also strengthens trust and loyalty, making it a must-have for modern financial services.

What Is Conversational AI?

Conversational AI is a technology that allows computers to talk with humans using text or voice. It understands customer questions and replies naturally, just like a real person.

It uses simple technologies such as Natural Language Processing (NLP), machine learning, and data analysis. These tools help the system understand words, meaning, and intent. Unlike old chatbots that only follow rules, Conversational AI learns from conversations and gets better over time.

How Conversational AI Works in Banking

-

Works through chat windows, mobile apps, websites, and voice systems.

-

Reads and understands customer messages to provide accurate answers.

-

Many users search for what conversational AI is, even while using it daily.

-

Common tasks handled: checking balances, blocking lost cards, and loan inquiries.

-

Integrated with core banking systems for real-time, accurate information.

-

Improves speed, reliability, and efficiency of customer service.

Key Areas Where Conversational AI Is Changing Banking

1. Customer Support and Service

Customer support is one of the biggest areas of change. Conversational AI can answer common questions like balance checks, transaction history, interest rates, and branch details instantly. This reduces call center load and improves response time.

2. Account and Transaction Assistance

Customers can transfer money, check payment status, and receive alerts through chat or voice. This makes banking easier, especially for mobile users.

3. Loan and Credit Support

Banks utilize Conversational AI and AI solutions to guide users through loan options, eligibility checks, and document submission processes. Many users searching for what conversational AI is are surprised to see how smoothly loan queries are handled today.

4. Fraud Detection and Alerts

AI systems can send instant alerts for unusual activity and guide customers on next steps. This improves security and trust.

5. Personalized Banking Experience

Conversational AI studies customer behavior and offers personalized suggestions like savings plans, credit cards, or investment options.

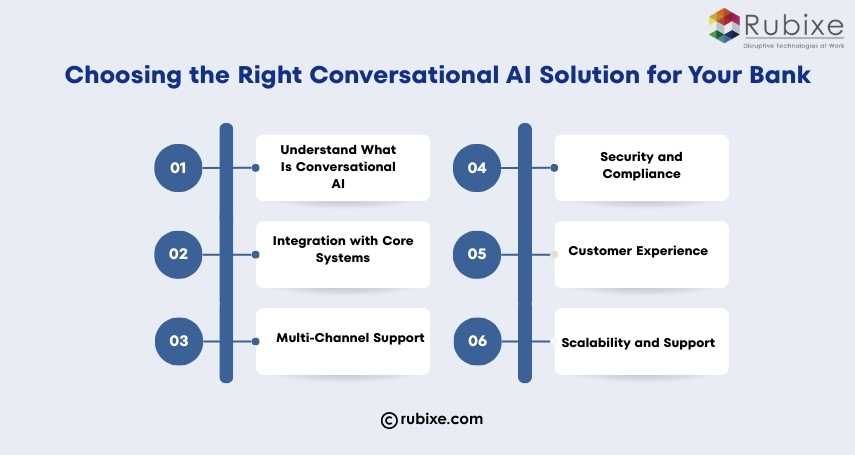

Choosing the Right Conversational AI Solution for Your Bank

-

Understand What Is Conversational AI: Choose a system that can understand questions naturally and improve over time.

-

Integration with Core Systems: Ensure the AI connects seamlessly with banking systems for accurate information.

-

Multi-Channel Support: Supports mobile apps, websites, messaging apps, and voice assistants for flexible customer access.

-

Security and Compliance: Must follow strict data protection rules and comply with banking regulations.

-

Customer Experience: Provides fast, accurate, and helpful responses, understands multiple languages or accents.

-

Scalability and Support: Can handle increased traffic during peak times and includes reliable vendor support.

Benefits of Conversational AI for Banks and Customers

The benefits are clear for both sides.

For banks:

-

Lower customer service costs

-

Faster issue resolution

-

Better customer engagement

-

Easy scaling during high demand

For customers:

-

24/7 support

-

Faster answers

-

Simple banking tasks

-

Less waiting and confusion

Many banking leaders now understand what conversational AI is and see it as a long-term solution, not a short-term tool.

Trust, Accuracy, and Compliance in Banking AI

Banking requires high trust and accuracy. Conversational AI systems are designed with strong data security rules. They follow banking regulations and protect customer data.

Banks also use human review and regular testing to make sure responses are correct. This builds confidence among users and regulators.

Expert teams train these systems using real banking data and customer queries. This ensures the AI provides useful and safe information.

Future Trends of Conversational AI in Financial Services

-

Voice Banking: Customers can use natural language in multiple languages to interact with banks easily.

-

Predictive Banking: AI can suggest actions like payments, savings, and investment opportunities based on behavior.

-

Data-Driven Insights: Integration with analytics allows banks to provide personalized advice and improve customer decisions.

-

Human-Like Interactions: AI will understand emotions, context, and complex queries for more natural conversations.

-

Enhanced Security & Compliance: Future systems will be more secure while offering quick and reliable services.

-

Overall Impact: Faster support, smarter recommendations, and a seamless banking experience for customers.

Conversational AI is no longer something banks can avoid. It has become an important part of modern banking. Banks now use it for customer support, fraud alerts, and personalized services, and the results are clearly visible.

Now that we clearly understand what conversational AI is, it is easy to know why banks are using it more and more. It helps banks give faster service, reduces manual work, and creates better relationships with customers. For banks that want to grow, stay competitive, and offer simple digital services, Conversational AI is the right solution.