Revolutionizing Finance with AI Consulting Solutions

AI consulting transforms financial services through tailored strategies and intelligent automation, enabling firms to enhance efficiency and customer experience.

AI is changing the way the finance industry works. With the help of AI consulting solutions, banks and financial companies can now make better decisions, improve customer service, and detect fraud more quickly. These tools analyze large amounts of data to find patterns and give useful insights. By working with AI experts, businesses can use the right technology for their needs and goals. This leads to faster operations, fewer errors, and a better experience for customers.

A New Era for Finance Begins with Intelligence

The finance industry is undergoing a seismic shift driven by data, automation, and the need for real-time decision-making. Traditional financial models struggle to keep pace with today’s digital demands. That’s where AI consulting becomes the strategic game-changer.

From personalized banking to real-time fraud detection, AI is not just a tool—it’s becoming the core of modern financial strategy. But leveraging it effectively requires deep domain knowledge, technical expertise, and execution experience. Leading AI consulting companies help bridge this gap.

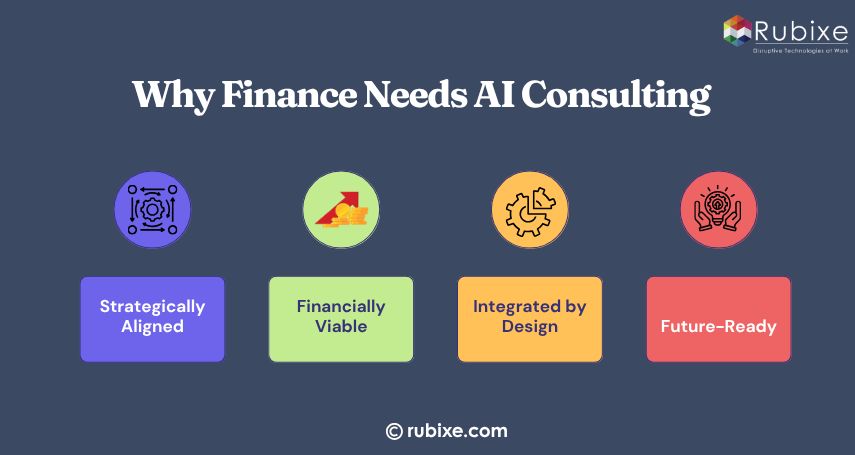

Why Finance Needs AI Consulting, Not Just AI Tools

Financial institutions often deploy AI tools without fully integrating them into business logic or compliance frameworks. The result? Misalignment, underperformance, and siloed innovation.

AI consulting ensures that every AI initiative is

-

Strategically Aligned: Each AI solution is developed with a clear connection to long-term business objectives. It supports both growth strategies and compliance with evolving regulatory standards, ensuring sustainable success.

-

Financially Viable: Projects are evaluated not just for technical success but for measurable return on investment. The focus is on improving efficiency, reducing costs, and transforming key business processes in meaningful ways.

-

Integrated by Design: AI tools are built to work seamlessly within existing legacy systems and workflows. This ensures smooth adoption across teams and avoids the pitfalls of disconnected, one-off solutions.

-

Future-Ready: Solutions are architected to adapt to growing data volumes, emerging technologies, and shifting market needs. They are flexible enough to expand without requiring complete redesigns, enabling long-term agility and value.

Key Applications of AI in Financial Services

AI's real value lies in its practical applications across finance. When led by expert consultants, these solutions become core to enterprise growth:

-

Fraud Detection: AI monitors transaction patterns and flags anomalies instantly.

-

Credit Scoring: Predictive analytics improve loan approval decisions and reduce risk.

-

Algorithmic Trading: Real-time data models help firms execute trades faster and smarter.

-

Customer Support: AI chatbots resolve queries 24/7, improving satisfaction.

-

Regulatory Compliance: Automated tools ensure consistent adherence to complex policies.

These innovations require thoughtful AI implementation in financial services, guided by strategic vision and expert execution.

AI Strategy for Finance Companies: Building the Right Foundation

Every successful AI transformation starts with a clear, actionable strategy. For finance companies, this involves:

-

Data Infrastructure Review: Assess data quality, silos, and governance policies.

-

Use Case Prioritization: Focus on functions that will see the highest ROI and quickest adoption.

-

Compliance Alignment: Build models that meet data privacy, KYC, AML, and other regulatory needs.

-

Roadmap Development: Define phased goals for pilot testing, feedback loops, and scaling.

An experienced AI consulting company will tailor this strategy to your unique market, risk profile, and operational goals.

The Role of AI Services in Operational Transformation

Beyond algorithms, true transformation comes from optimized systems, processes, and culture. Rubixe’s end-to-end AI services provide:

-

Custom AI Model Development: We build AI models tailored to specific financial use cases such as fraud detection, credit scoring, or customer segmentation to deliver focused results.

-

Implementation and Integration: Our solutions are designed to work seamlessly with your existing banking and financial systems, ensuring quick and efficient deployment.

-

Training and Adoption Support: We provide training and support to help your teams understand, adopt, and make the most of AI tools in their daily workflows.

-

Performance Monitoring: We regularly track and evaluate models to ensure they remain accurate, unbiased, and transparent throughout their lifecycle.

Addressing Compliance and Security in AI-Driven Finance

Regulatory pressure is one of the most critical challenges in the financial industry. That’s why compliance is a non-negotiable component of any AI deployment. With the help of experienced AI consulting companies, institutions can:

-

Build AI systems that comply with GDPR, PCI DSS, and sector-specific regulations.

-

Use explainable AI (XAI) models to support audit trails and transparency.

-

Detect suspicious activities to satisfy AML and KYC requirements.

-

Ensure data anonymization and protection through secure model pipelines.

Artificial intelligence consulting in banking is about trust, and security is the foundation of that trust.

Unlocking Competitive Advantage through Personalization and Forecasting

What sets successful companies apart in financial transformation is how effectively they use AI to better understand their customers and anticipate market trends

-

Hyper-Personalized Products: Using machine learning to recommend tailored investment portfolios, credit options, and spending insights.

-

Sentiment and Risk Analysis: AI tools to analyze investor sentiment and detect market volatility.

-

Real-Time Forecasting: Enhanced financial planning and revenue modeling with predictive algorithms.

-

Behavioral Analytics: Deeper insights into user habits for cross-selling and churn prevention.

Why Rubixe as Your AI Consulting Partner?

We don’t just implement AI. We help financial organizations transform with confidence. Here’s why Rubixe stands out:

-

Finance-Specific Expertise: Deep experience with banking, fintech, and regulatory environments.

-

Outcome-Focused Delivery: Projects tied to cost reduction, efficiency, or revenue growth.

-

Trusted Methodology: Agile, transparent, and scalable delivery models.

-

Proven Track Record: Case studies and partnerships that speak to successful execution.

Future of AI in Finance: Evolving from Smart to Autonomous

AI's role in finance is only growing. What began with process automation is expanding to:

-

Self-Learning Risk Models: AI models that adapt in real time to market behavior, improving the accuracy of risk predictions and decision-making.

-

Autonomous Advisors: Advanced robo-advisors that use real-time behavioral insights to deliver personalized, responsive financial advice.

-

Real-Time Forecasting: AI-powered predictions that adjust instantly to market shifts, helping with pricing, investment, and planning.

-

Sustainable Finance Tools: Intelligent systems that automate ESG scoring and reporting, supporting responsible investing and compliance.

AI consulting is reshaping finance by enabling smarter decisions, faster operations, and better customer experiences. With the right strategy, tools, and expert support, financial institutions can stay compliant, competitive, and future-ready. Partnering with a trusted AI consulting firm ensures meaningful transformation that aligns with business goals and delivers measurable impact.